Special to WorldTribune, June 30, 2022

Analysis by Joe Schaeffer, 247 Real News

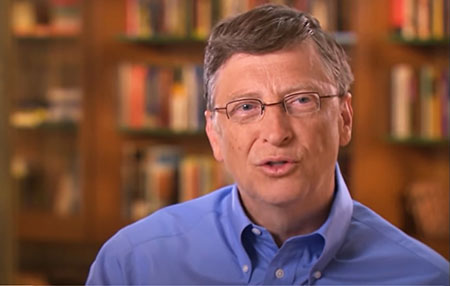

Bill Gates really wants the whole world tied to a digital financial system.

In his latest “Gates Notes” blog post on June 29, the multi-billionaire world-shaper was waxing ecstatic over the tremendous rise in the number of human beings across the planet who are now tied into the electronic banking system.

Gates wrote:

Today, about three quarters of people worldwide have an account at a financial institution or through a mobile money provider. That’s a 50 percent increase in the past ten years, and the growth has not just been in higher-income countries. Developing countries have increased 71 percent in that time.

This is important to him.

As always, Gates paints the development as a wonderful advance for humanity:

This growth is great news because it means that more low-income people — and especially low-income women — are being empowered to use products that let them make and receive payments, save and borrow money, and get insurance. Both research and experience show that this financial inclusion helps people exit and stay out of poverty. And using digital technology to do it is a low-cost way to build economic resilience and reduce extreme poverty, which is why it’s an essential part of the Gates Foundation’s strategy. We have granted several hundred million dollars to partners who are helping low- and middle-income countries build digital financial systems.

What Gates leaves unsaid is that 75 percent of the human race now has a greatly enhanced digital fingerprint available to technocrats that includes their financial means of survival.

Bill Gates is very comfortable with the World Bank amassing an enormous digital library of the financial practices of ordinary people:

Yet even the exemplar countries aren’t reaching everyone who needs digital banking. That’s why the World Bank (with support from the foundation) runs the Global Findex database, a comprehensive survey of how adults borrow, save, and send money and manage risks. The Findex has been updated periodically since 2011, and the latest version was just published earlier today. Using data gathered from 128,000 adults in 123 economies, it highlights steps that will expand formal banking to everyone in the world who wants it.

In his blog post, Gates links to a Bill & Melinda Gates Foundation web page detailing the “philanthropists’” extensive efforts to connect all the citizens of the world to the digital banking system:

In just the past six years, 1.2 billion people worldwide have gained access to bank and mobile money accounts. This revolution in financial inclusion has the potential to offer a pathway out of poverty for hundreds of millions of people and to spur broad economic growth.

We work to expand the availability of affordable and reliable financial services that serve the needs of all, including the world’s poorest people.

Digital technologies and changes in national policy are clearing away obstacles that once kept these services out of reach for many, but tough challenges remain.

We work with our partners to support public and private investment in digital payment infrastructure, new regulatory standards, and gender equality initiatives such as digitized government benefit payments, to ensure continued progress toward the promise of financial inclusion.

In an interview with PC Magazine posted June 2, Gates re-emphasizes his commitment to a digital currency:

Q: You’ve made the full move to philanthropy; how hard was it to leave Microsoft and a lifetime career in technology?

A: While my day-to-day focus has shifted toward philanthropy, I’m still very much involved in technology as I meet regularly with groups at Microsoft and talk about their product plans. That’s something I really enjoy. And my work at the foundation, where we’re exploring things like digital currency or empowering health workers with digital tools, challenges me to understand the latest advances and think about how we put them into usable forms to save lives.

Gates makes it clear that he is a firm believer in the need for a trans-national order that can “work in a common way across humanity” to solve global crises:

Q: What will be the greatest technology challenge of the next 40 years and how will we overcome it?

A: There are a lot of challenges ahead of us that require technology and innovation. Climate change is a big one. Political polarization is another big one – how can we work in a common way across humanity and minimize wars and violence. There’s not a tech tool that can solve that, but the way we’re interconnected and interact with each other is so tied to how information flows around the world.

The digitalization of the world’s population’s personal cash holdings has long been a priority for Gates. In his Gates Notes’ 2015 Annual Letter he specifically listed mobile banking as one of four exciting “breakthroughs” for humanity over the proceeding 15 years:

But in the next 15 years, digital banking will give the poor more control over their assets and help them transform their lives.

The key to this will be mobile phones. Already, in the developing countries with the right regulatory framework, people are storing money digitally on their phones and using them to make purchases, as if they were debit cards. By 2030, 2 billion people who don’t have a bank account today will be storing money and making payments with their phones. And by then, mobile money providers will be offering the full range of financial services, from interest-bearing savings accounts to credit to insurance.

When all the world’s eggs are in one big global basket, all the would-be technocrat masters of the universe have to do is manipulate that single basket.

We’re seeing it happening right now with the food supply chain before our very eyes. “At the same time globalists are warning of worldwide food shortages, an odd series of disasters have hit food processing plants throughout the United States,” WorldTribune noted on May 5.

The strange happenings have continued into summer.

Bill Gates is now the largest private owner of farmland in the U.S. At the same time, he is a particularly enthusiastic backer of laboratory-created fake meat.

This is the man who is spearheading the drive to get the entire world plugged into the economic banking system. Alarm bells are ringing and red flags are flying. Yet, as he writes himself, Bill Gates is succeeding in his mission.

About . . . . Intelligence . . . . Membership