Special to WorldTribune.com

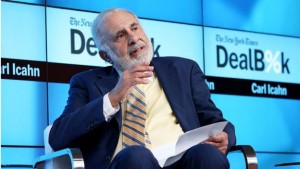

China’s economic downturn and government interference led billionaire investor Carl Icahn to dump his stake in Apple.

“We no longer have a position with Apple,” Icahn told CNBC.

Icahn came away with $2 billion after selling the stock. At one point last year, he owned 53 million shares worth $6.5 billion.

Poorer than expected sales of the iPhone in China was a major factor in Apple’s 13 percent drop in second quarter revenue.

Icahn also pointed to Beijing’s passing of a law in March that required all content shown in China to be stored on servers based on the Chinese mainland. As a result, Apple’s iBooks and iTunes movies services were shut down in China.

Icahn began acquiring Apple stock in the third quarter of 2013 when they were trading at about $68 a share. The stock has shed 27 percent in the past year. On April 28, shares closed down 3 percent at $94.83.

Icahn said he informed Apple chief executive Tim Cook of the share sale.

“I called him to tell him that, and he was a little sorry, obviously. But I told him it’s a great company,” he said.