Sol W. Sanders

While the Obama Administration has been busy lining the pockets of its campaign contributors with solar power handouts, an energy revolution is taking place even the Washington Luddites and GOSplanners can’t buck.

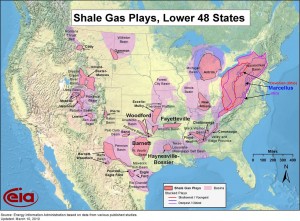

American technology, borrowing offshore deep-water drilling techniques, has started exploiting huge deposits of natural gas buried deep in the earth below shale rock. It would be hard to exaggerate the meaning of this “new” fuel for the American economy — and the world, what with three-quarters of the known new resources outside North America.

These discoveries already dwarf proved conventional gas reserves. A decade of early exploitation by American technological pioneers has produced a domestic natural gas surplus, so much so U.S. prices are a fraction of liquefied natural gas [LNG] prices in East Asia. There appear to be export prospects as soon as ocean terminals designed for LNG imports can be refitted — the first significant exports since the 1973 Arab Oil Embargo.

Billions of investment dollars are already rolling in for both U.S. upstream drilling and pipeline distribution rationalization — including from the savvy Norwegian White Sheikhs’ Statoil to the Chinese government oil companies. Yes, Beijing is not only looking for solid equities but wants technological transfers for their own country’s deposits double current U.S. estimates. A similar story is beginning to unfold from Poland to France — although Paris is hesitant because of competition with its massive investment in nuclear power — to Canada to Brazil, South Africa, Australia, Israel, India and Chile.

The question now is whether the Obama Administration will leave the industry to benign neglect. It’s no secret where the Administration’s heart is; in 2008 President Barack Obama warned of inevitability of skyrocketing energy bills in a scenario to help force a shift from fossil fuels to more expensive so-called renewable “green” energy. You would think what with windmill imports from China and Spain so severe Congress is being asked for tariff protection — after subsidized windpower outfits moved their jobs and technology offshore — and the fiasco in solar energy, the feds and their enviromentalista campfollowers would back off. Logic now dictates their Jeremiah calls of rapidly approaching “peak oil” — the time when increasing demand and depleted fossil fuels would meet — is even more distant.

But warning signs came with the August release by the Obama Energy Department of a 90-day “study” [without industry representation] of safety standards for the new technologies, ignoring already formulated industry “safe practices”. There could be contamination of the water supply, even though most shale gas lies at depths far below the aquifers. And there have been some miscreants. But the industry — well aware of the opposition the enviromentalistas can mount — are already planning self-policing.

What is self evident is increased sources of natural gas — the least polluting of all fossil fuels — is going to revolutionize the whole energy and environmental debate. Although the $2,000 cost of retrofitting a Detroit car to use natural gas rather than gasoline or diesel is a minor stumbling bloc, a network of filling stations would require big investment for a massive U.S. shift. Still, the glitterati’s fascination with electric cars ignores 60 percent of the nation’s demand is supplied by coal-fired turbines. [There is already a surfeit of recharging plugs for electric cars, selling poorly despite all the hoopla.] And, of course, gas-fired generating plants are the fastest way to meet rapid increases in electricity demand.

Other opportunities for changeover are closer. It is conceivable truck fleets could move quickly to the “new” fuel. A number of new petrochemical plants using broken out elements of shale gas promise new jobs, bringing production back to the U.S. There is growing interest, too, in high-energy requirements for expansion of recycled scrap metal for specialty steels. The international implications, politically as well as economically, are equally promising: Moscow’s attempt to blackmail Western Europe with a gas monopoly and the growing power of the unstable Persian Gulf OPEC LNG producers is going to be eroded.

Bottom line, as Gov. Rick Perry has argued, American recovery demands access to new energy. That’s not new. U.S. development always has depended on cheap energy, from our colonial forests to the development of early 20th century petroleum. Now, again, the shale gas revolution holds out that promise at a time when the economy desperately needs a shot in the arm.

Sol W. Sanders, ([email protected]), writes the ‘Follow the Money’ column for The Washington Times on the convergence of international politics, business and economics. He is also a contributing editor for WorldTribune.com and East-Asia-Intel.com.