Editor’s Note: The above FREE webinar for WorldTribune.com readers is offered by Romulus on July 20.

Special to WorldTribune, July 19, 2023

MARKET Watch

by R. Clinton Ohlers

WorldTribune‘s Investigative Editor Clinton Ohlers recently met with WT Columnist, market analyst, and trading educator, Romulus, for an interview on navigating the financial markets. The Endowment for Press Freedom, referenced below, is part of the Free Press Foundation [FreePressFoundation.org]

World Tribune:

Why are you passionate about helping people learn to manage their own money the markets, particularly by offering a webinar for WorldTribune.com readers?

Romulus:

When I started on Wall Street in 1984, everybody around me — the firm I worked for, the firm’s up and down the street, the banks, the brokers, the 1000s of employees, the billions and trillions of dollars — they were all just focused on one thing: trying to make money for themselves and their own firms.

They really didn’t care about the outcome for their customers and clients.

I’ll tell you a story. There’s a book about a guy named Jesse Livermore. He was trading about 100 years ago, through all kinds of interesting times back in World War I, the roaring 20s, and the crash. He made so much money in the crash of ’29 that they estimated by the end of that day, he was the second wealthiest man on earth.

He made so much money and everybody else lost so much money, truly an astounding type of character.

But when Livermore was building his career, he noticed just like I noticed that the people all around me weren’t concerned to help people truly made money in the markets. At the end of his career, he said that there was an attitude on Wall Street of “we’re gonna get a bunch of people to come on, join us to follow us, and when they burn out, we’ll find a bunch of new people.”

That has never been my focus from day one. I’ve concentrated on helping people make money from the markets, regardless of market direction, whether up or down.

Related: Ancient Roman predicted Bitcoin crash, June 28, 2021

That’s why people need to attend this webinar. We’re going to talk specifically about that, about helping everybody ensure that their portfolio that their financial situation for themselves and their families are going to be secure and growing, regardless of what goes on in the markets. Regardless of what goes on in the outside world.

WT:

If you are like me, anyone who has created a footprint online that demonstrates one is interested in the financial markets, you are just deluged with YouTube and Google ads for trading strategies following this person’s or that person’s stock picks or options trades.

What sets you apart from that huge mass?

Romulus:

It comes down to training. Fortunately, there’s always been a small group of people who who know how to succeed on Wall Street on a consistent basis. I was eventually introduced to Ralph Acampora who has been doing this for well over at least 55 years. He was my first teacher, my first mentor.

He taught me the value of not just following the crowd, the herd, but being independent. This goes back to what we said a moment ago, not being dependent upon a bull market in order to make money for myself and my customers.

All the other places that you’re talking about, social media influencers and trading schemes, they only make money if the market goes up. The market goes up two thirds of the time, but when it comes down that one third, it comes down hard.

Club Romulus: Where knowledge plus action equals profit

But it isn’t just young influencers. Take Cathy wood from Ark Capital. She loads up on these super leading edge, smaller technology companies and Tesla. So when the basket of stocks that she manages, went up to $160 per share, everything’s great.

But then 2022 came in and her basket drops all the way down to I think $35 per share. I mean losses were just mind numbing. She’s just absolutely crushed her people.

That’s across the board out there. These people just got lucky with an up market. They have no clue how to make money on a consistent repeatable basis.

Or take a YouTuber who got lucky on Tesla when it went up and up. He got an enormous number of followers and came under the misguided idea, the illusion that he can help other people invest in trading stock.

It is freaking insane from start to finish, but that’s the way these things get foisted upon the public.

For years, this individual was pushing the stock called Tattooed Chef. TTC if anyone wants to look this up. I remember two years ago, the stock was at $30 per share. Every $10 it drops, he keeps telling people “buy more, buy more, buy more, buy more, buy more.”

Today it is at an all time, low of 13 cents a share. 13 cents. Wow.

Free Webinar: Victory Unit Masterclass

WT:

Cathy Wood’s AARK is an exchange traded fund. What about financial planners and hedge funds?

Romulus:

I’m concerned that financial planners are not going to be safe, that they’ll lose their money. If the bear market returns, they’ll have a loss for sure.

The reason I believe this is they have been dependent upon an economic and political environment that is conducive to markets going up for many years in a row.

You have to ask yourself, after this huge debt bubble that we have used to generate all this wealth are we sitting on a house of cards? Are we sitting in the pigs house of straw or wood? Or are we sitting in the house of brick?

Some some hedge funds do make money when the markets go down. Ninety-five percent of them don’t. Just like 95% of the public doesn’t make money when the markets go down. They’re all the same. They only know how to make money when the markets go up.

They’re smart, sure, but being smart, academically, being smart in certain business climates doesn’t mean that you’re trading smart this meeting or investing smart, that you have trading and investing IQ.

If someone goes to Wharton, or Stanford or gets an MBA from Harvard, which is where a lot of the graduates end up from, and law schools, and end up going to the hedge funds. They learn about a lot of things about financial statements and and business and marketing. But they don’t learn about what I just told you. They don’t learn about trading and investing IQ.

What they love is making money when the markets go up.

And by their marching orders and their parameters they have to stay invested in the market. Because they look at a 100 year study and the market goes up two thirds of the time — so stay in it, you’ll eventually make money.

But you and I don’t have the time horizon. The Harvard endowment has been around for hundreds of years. We don’t have that kind of time.

Yeah, the market goes up eventually. But we have to make money in up markets and down markets.

WT:

Is there anything you would like to add?

Romulus:

Yes. We’re doing a free webinar on July 20 for WorldTribune.com and the Free Press Media Group. Please join us. We will show you awesome strategies and techniques that we’ve used for many, many years to help keep us straight, stay ahead of the markets and produce consistent returns regardless of market direction.

We’re very excited about it. And I believe that over the next several months this partnership that we have slowly been building with the readers is going to blossom into something truly fantastic, to help keep all the readers financially on track to grow their portfolios, and to give them opportunities to take advantage of whatever the markets throw.

To learn about and sign up for the free webinar, go here: Victory Unit Masterclass

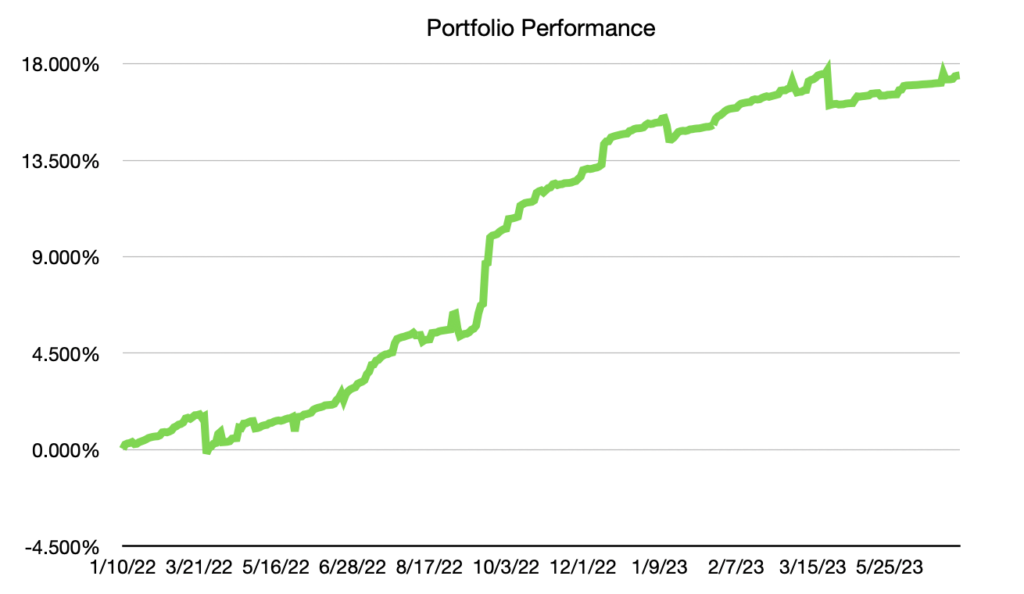

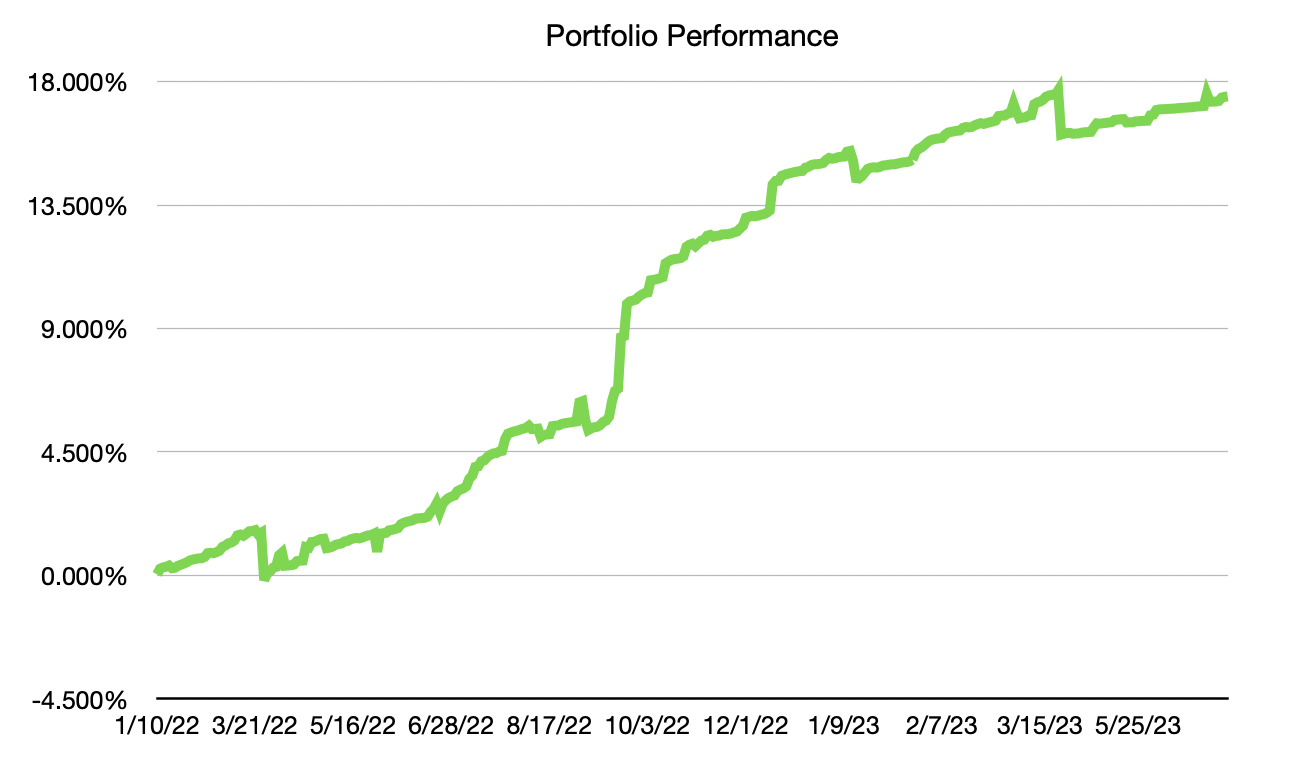

Club Romulus portfolio performance from January 2022 to July, 2023: +17.46%. S&P500 during the same period: -7.70%. The following graph approximates the potential growth of the Endowment for Press Freedom.