by WorldTribune Staff, March 10, 2023

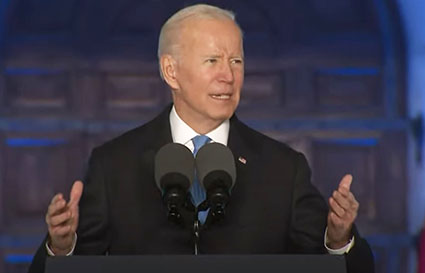

American individuals and businesses will be hit with a boatload of tax increases under Joe Biden’s Fiscal Year 2024 budget.

The proposal contains nearly $4.7 trillion in new tax increases. That is on top of the $700 billion in tax hikes Democrats force fed Americans as part of the so-called Inflation Reduction Act late last year.

Americans for Tax Reform broke down the new Biden tax hikes:

Highest Personal Income Tax Rate Since 1986

Biden’s budget calls for a top combined federal tax rate of about 45%, the highest since 1986.

Highest Capital Gains Tax Since 1978

Biden’s plan nearly doubles the capital gains tax rate for investment to 39.6% from 20%.

Higher Corporate Tax Rate

The Biden plan raises the current 21% federal corporate income tax rate to 28%.

Americans for Tax Reform noted: “After adding state corporate income taxes, the combined federal-state rate under Biden amounts to about 32%. American workers would bear the brunt of Biden’s corporate tax increase.”

Corporations will pass the Biden tax increase along to families “in the form of higher prices of goods and services. It will also lead to lower wages and fewer jobs.”

Wealth Tax on Unrealized Gains

Biden’s budget calls for an annual 20% minimum tax on the unrealized gains of individuals with income and assets that exceed $100 million.

“Capital gains taxes should only be paid when an asset is sold. Biden’s proposal would break with current tax policy and tax Americans based on the value of an asset on a particular arbitrary date,” Americans for Tax Reform noted.

“This unprecedented tax would empower the IRS, encourage taxpayers to move assets overseas, and could grow to hit millions of Americans over time. It would also harm the economy, impose retroactive taxation, has failed everywhere it has been tried before, and would likely be struck down by the Supreme Court as unconstitutional.”

Tax on Stock Buybacks Quadrupled

Democrats imposed a 1% stock buyback tax on Jan. 1. Just months later, Biden’s budget calls for quadrupling the tax, the burden of which hits every American with a 401k, IRA, or union pension.

$31 Billion Tax on American Energy

Biden is calling for new taxes on oil and gas companies totaling $31 billion. These tax hikes will be passed on to consumers in the form of higher gas prices and energy bills.

32% Increase to Medicare Taxes

Biden proposes raising Medicare taxes from the current rate of 3.8 percent to 5 percent for individuals making over $400,000 per year, roughly a 32 percent tax hike. The plan reportedly broadens the Net Investment Income Tax to apply to business income as well as investments, wages and self-employment income.

As noted by the Wall Street Journal, this tax hike combined with the increase in the marginal income tax rate would saddle the U.S. with the highest income tax rate in decades: “If Biden again proposes raising the top marginal income tax to 39.6% from 37%, he would be seeking a combined top federal tax rate of 44.6%, higher than at any point since the mid-1980s. If that became law, the combined marginal tax rate on top earners would exceed 50% in many states.“

Carried Interest Tax on Capital Gains

This tax hike would hit private equity, venture capital, real estate partnerships, and their portfolio companies which together account for over 25 million American jobs.

“In response, firms would downsize and decrease investment, causing both a loss of jobs and a reduction in the returns investors see,” Americans for Tax Reform noted.

$23 Billion Retirement Tax

The budget proposal calls for capping the retirement plan benefits of certain individuals. The White House projects this limitation on retirement benefits will raise $23 billion in taxes from individuals with retirement account balances above $10 million and earnings above $400,000.

$24 Billion Cryptocurrency Tax

Biden plans to raise taxes on cryptocurrencies by $24 billion by changing the tax treatment of their transaction by applying “wash sale” rules.

Under current IRS rules, a wash sale occurs when an investor sells “stock or securities” at a loss, and either 30 days before or after the sale, purchases a “substantially identical” stock or security. The IRS prohibits any deduction of losses when a transaction like this occurs.

Biden wants to apply this rule to crypto transactions.

“This will limit crypto investors’ flexibility to deduct losses. What makes this issue more complicated is that Congress and federal regulators have so far failed to develop the rules of the road for determining whether crypto assets are commodities or securities. Digital assets are diverse and do not necessarily function like securities and should not necessarily be treated like them,” Americans for Tax Reform said.

Real Estate Tax Hike

Biden proposes raising taxes on capital gains from real estate transaction by ending what are known as 1031 Like-Kind Exchanges.

Under current tax rules, real estate investors can exchange real property used for business for similar real property and defer capital gains tax.

Americans for Tax Reform noted: “Biden’s proposed changes to this tax treatment will hurt individuals and farmers. Many of Biden’s constituents have previously claimed that ‘those who rely most on section 1031 aren’t large corporations, but individual Americans who own investment property, from urban apartments to farms to forests.’ ”

Doubles the Global Minimum Tax

The plan calls for doubling the tax on Global Intangible Low-Tax Income (GILTI) on U.S. multinational corporations from 10.5 to 21 percent, which after the disallowance of foreign tax credits would provide a top rate of 26.25 percent.

Biden’s proposed changes to GILTI would lead to a $340 billion tax hike over the next decade, could eliminate one million jobs and cause $20 billion in lost economic activity, according to a recent EY report published by the National Association of Manufacturers.

Action . . . . Intelligence . . . . Publish