FPI / October 11, 2020

Commentary by Jason Orestes

The U.S. is reliant on adversarial nations like Russia and China for a lot of its vital rare earth mineral needs.

Some of these materials are even used in technology that is needed for oil and gas extraction. A lot of harm could be wrought on U.S. industry by a rare materials trade war. This reliance could absolutely be used as a weapon and retaliation against the U.S..

President Donald Trump appears to be aware of this. His recently announced executive order has requested the Department of Defense to produce an inventory for materials it relies on and cannot independently produce. This list will be long, as many American companies rely on foreign countries to supply such materials.

Of the 35 necessary rare earth minerals, the U.S. must import more than half its supply of 31 of them. The U.S. has no domestic capacity at all for 14 of them.

As we previously reported, the U.S. under the Trump administration is taking aggressive strategic steps to limit Chinese companies from attaining semiconductor independence. It recently banned U.S. companies from engaging with China’s largest chip manufacturer SMIC under the guise of national security.

While I typically agree with these rather broad designations of “national security”, this one feels more tactical, and a surgical attempt by the U.S. to stymie China’s technological abilities. A long overdue reciprocal dealing after decades of having U.S. tech and IP constantly stolen by the Chinese Communist Party (CCP).

However, China has something of a countervailing response in their arsenal, and the U.S. would be wise to be very proactive in mitigating it. Thankfully, the Trump administration has begun to take steps to get out in front of it.

Rare earth materials are the mined minerals that are necessary for a wide array of electronics, batteries, magnets, lighting, and semiconductors. While semiconductors are critical to all electronics, rare earth materials are basically critical to semiconductors.

Pini Althaus, the CEO of U.S.A Rare Earth, described the order as “an important step…. It also addresses supply chain vulnerabilities based on our ability to source the critical materials we need for defense and manufacturing.” I agree, and believe the U.S. should continue to take rapid prophylactic action to work on mitigating its reliance on China for these minerals.

Just as our reliance on China for things like PPE is unacceptable, this too presents what is a very serious national security issue, especially in light of a U.S. more willing to stand up to Chinese mercantilism. The executive order described the reliance on these minerals from “adversaries” representing an “unusual and extraordinary threat”. Thankfully, we have some ability to begin reducing this dependence.

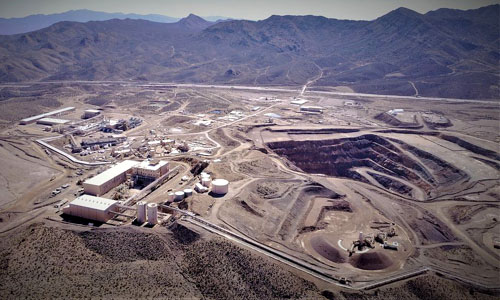

Related: Texas mountain to end U.S. dependence on China for strategic rare earth minerals, April 8, 2020

States like Alaska have strong abilities for mining rare earths, per Alaska Senator Dan Sullivan. Not only can these steps help assure U.S. independence for critical materials, it also can help create some valuable jobs. Rare earth mining is often upwards of six-figure salary potential, and how the U.S. extracts them is also kinder on the environment than China’s mining of them. The executive order is also oriented towards galvanizing American mining; perfectly aligned with an America First mindset while also protecting national security.

This executive order isn’t only aimed at China, and will make it more difficult to transact for these materials with countries that are either adversarial to the U.S. or don’t maintain rare earth supply chain standards to the U.S.’s liking. The Senate is also placing an emphasis on this by way of its Onshoring Rare Earths Act, which has bipartisan support. Much of the legislation is centered around encouraging investment and activity in the U.S. rare earth industry by way of tax incentives and grant programs.

This is one of those unsung economic issues that could present a serious issue in a protracted Cold War; something that more and more feels like an inevitability with China. This is an encouraging development and one that warrants more attention that it gets.

Jason Orestes (@market_noises) is a former Wall Street financial analyst who focuses on contemporary political developments affecting economics, markets, and culture. His commentary can be found on Washington Examiner, TheStreet, MSN Money, RealClearMarkets, and RealClearPolitics.

FPI, Free Press International