by WorldTribune Staff, December 21, 2017

U.S. businesses responded immediately and positively to President Donald Trump’s Christmas gift of tax cuts.

Americans may begin to see higher take home pay beginning in February.

Reactions from businesses to the bill’s passage included:

- AT&T said it will pay $1,000 bonuses as soon as Trump signs the tax cut bill into law and promised to invest an extra $1 billion in America in 2018.

- Boeing announced a plan to spend an additional $300 million on its employees and charities, also tied to the tax plan.

- FedEx says if tax cuts spur GDP growth it will likely expand hiring.

- Comcast NBCUniversal said it will give $1,000 bonuses to more than 100,000 workers.

- A Cincinnati bank said it will give bonuses to 13,500 employees of $1,000 each and raise its minimum wage to $15 per hour because its tax rate will soon plummet.

- Wells Fargo is matching that $15 minimum wage and giving $400 million to charities.

Meanwhile, Trump’s daughter and adviser Ivanka Trump and Sen. Tim Scott, South Carolina Republican, emerged as key players in getting the tax deal through Congress.

Sen. Bob Corker, who has had his share of dust-ups with the president this year, told Fox & Friends that Ivanka Trump “deserves a lot of credit” for the legislation’s passage.

Scott, who was a key advocate for the legislation on the Senate floor and in media interviews, said: “Let me say to those Americans who are watching this process, this is not about Washington. It’s not about the left. It’s not about the right. It’s about single parent mom’s who are looking for a reason to be hopeful in 2018.”

Scott added that the Trump tax plan “doubles the child tax credit and makes about 70 percent of it refundable. This is a plan that we can be proud of because it speaks to the hearts of everyday Americans.”

The tax credit was the brainchild of Ivanka Trump and Sens. Marco Rubio of Florida and Mike Lee of Utah.

Ivanka Trump, appearing on Fox & Friends, applauded Sen. Scott as “incredible. Really it was very nice to work as a collective towards a unified nation,” she said.

“I’m really looking forward to doing a lot of traveling in April when people realize the effect that this has both on the process of filling out their taxes, the vast majority will be doing so on a single postcard,” she added. “But also having experienced the relief that will be starting as early as February. So then it will be a real privilege to show not only what the companies are doing but the personal impact that it’s going to have to so many people across this country.”

As part of the largest overhaul of the U.S. tax code in 30 years, the tax rate on corporations will drop from 35 percent to 21 percent. The president had previously called the measure “rocket fuel” for the economy.

AT&T CEO said the new 21 percent corporate tax rate would put the U.S. “in line with the rest of the industrialized world. This new lower rate encourages businesses to invest more in the United States. And more investment creates more good-paying jobs and increases economic growth.”

Just prior to AT&T’s announcement of employee bonuses, Senate Minority Leader Chuck Schumer, New York Democrat, slammed the company as a greedy corporation that would use its tax cut to buy back its stock and reward its executives.

“Over the last ten years, AT&T has paid an average tax rate of 8 percent a year. They have 80,000 fewer employees today than they had then,” Schumer said. “Tax breaks don’t lead to job creation. They lead to big CEO salaries and money for the very, very wealthy.”

House Minority Leader Nancy Pelosi, California Democrat, said the tax cuts represented “the worst bill in the history of the United States Congress.”

Trump predicted that an outpouring of domestic investment from American companies would be “very special. We’re bringing the entrepreneur back into this country. We’re getting rid of the knots and all the ties and we’re going to – you’re going to see what happens. And ultimately what does it mean? It means jobs. Jobs jobs, jobs.”

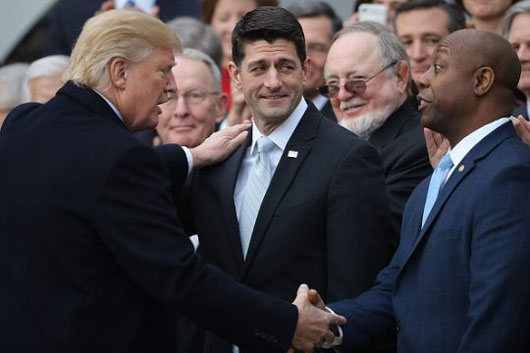

And what would Christmas be without a few Grinches. Huffington Post contributor Andy Ostroy took to Twitter to label Scott “a manipulated prop” for his presence during a victory celebration for the tax bill at the White House and criticized the senator for being the “ONE black person” standing by Trump.

Scott fired back on Twitter: “Uh probably because I helped write the bill for the last year, have multiple provisions included, got multiple Senators on board over the last week and have worked on tax reform my entire time in Congress. But if you’d rather just see my skin color, pls feel free.”

Subscribe to Geostrategy-Direct __________ Support Free Press Foundation