by WorldTribune Staff, April 1, 2021

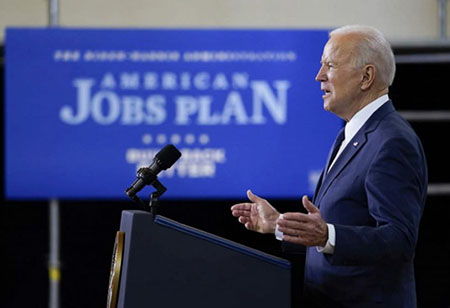

Joe Biden on Wednesday rolled out his team’s $2.3 trillion infrastructure plan which includes massive tax increases on businesses.

Former President Donald Trump said the “radical” proposal is built on “ludicrous” tax hikes that would end up sending U.S. business elsewhere — including to China.

“Joe Biden’s radical plan to implement the largest tax hike in American history is a massive giveaway to China, and many other countries, that will send thousands of factories, millions of jobs, and trillions of dollars to these competitive nations,” Trump said in a statement released by his 45 Office on Wednesday.

“The Biden plan will crush American workers and decimate U.S. manufacturing, while giving special tax privileges to outsourcers, foreign and giant multinational corporations.”

Trump blasted the Biden tax increases he said would “break the back of the American worker” and said “American is once again losing the economic war with China.”

“This legislation would be among the largest self-inflicted economic wounds in history,” Trump continued. “If this monstrosity is allowed to pass, the result will be more Americans out of work, more families shattered, more factories abandoned, more industries wrecked, and more Main Streets boarded up and closed down — just like it was before I took over the presidency.”

The latest statement from Trump came a day after he said there’s “hope” he’ll run again during an interview with in-law Lara Trump on her “The Right View” web show.

Socialist Rep. Alexandria Ocasio-Cortez of New York said Biden’s $2.3 trillion proposal “is not nearly enough” and “needs to be way bigger.”

“We’re talking about realistically $10 trillion over ten years,” AOC said. “And I know that may be an eye-popping figure for some people, but we need to understand that we are in a devastating economic moment. Millions of people in the United States are unemployed. We have a truly crippled health-care system and a planetary crisis on our hands.”

Here’s how Ocasio-Cortez explained that taxpayers will be able to pony up many trillions more than Team Biden proposed:

“We’re the wealthiest nation in the history of the world. So we can do $10 trillion.”

Team Biden plans to pay for the infrastructure bill through a series of business-related tax hikes including raising the corporate income tax rate to 28 percent. Trump slashed it to 21 percent from 35 percent during his tenure.

Senate Minority Leader Mitch McConnell of Kentucky likened the infrastructure package to a “Trojan horse.”

“It’s called infrastructure. But inside the Trojan horse is going to be more borrowed money and massive tax increases on all the productive parts of our economy,” McConnell said.

Senate Majority Leader Chuck Schumer, New York Democrat, signaled that he could pass the bill via budget reconciliation to circumvent Republican opponents. Democrats used the reconciliation process to shut out GOP opposition and pass the massive covid relief package which had very little to do with covid relief.

“Addressing infrastructure, climate and environmental justice together, and creating millions of good-paying jobs, is just the right combination to meet head on the challenges that America now faces,” Schumer said Wednesday.

Reps. Bill Pascrell and Josh Gottheimer of New Jersey and Tom Suozzi of New York, meanwhile, are demanding that Biden’s plans repeal a $10,000 cap on the state and local tax deduction, known as SALT in tax-speak, that was one of the more contentious features of the Trump tax cuts in 2017.

McConnell mocked House Democrats for settling on a tax break that overwhelmingly flows to the wealthy as their line in the sand.

“Don’t worry, coastal elites — House Democrats are demanding a special SALT carve-out that would cut taxes for wealthy people in blue states,” he said.

INFORMATION WORLD WAR: How We Win . . . . Executive Intelligence Brief